Analysis of Creditsafe’s COVID-19 Impact Score shows that over 26 percent of all US companies have been discovered to be at greater risk of failure because of the crisis. Many of these businesses are already displaying increased signs of distress as they are now delaying payment to their suppliers by up to 50 days beyond agreed terms.

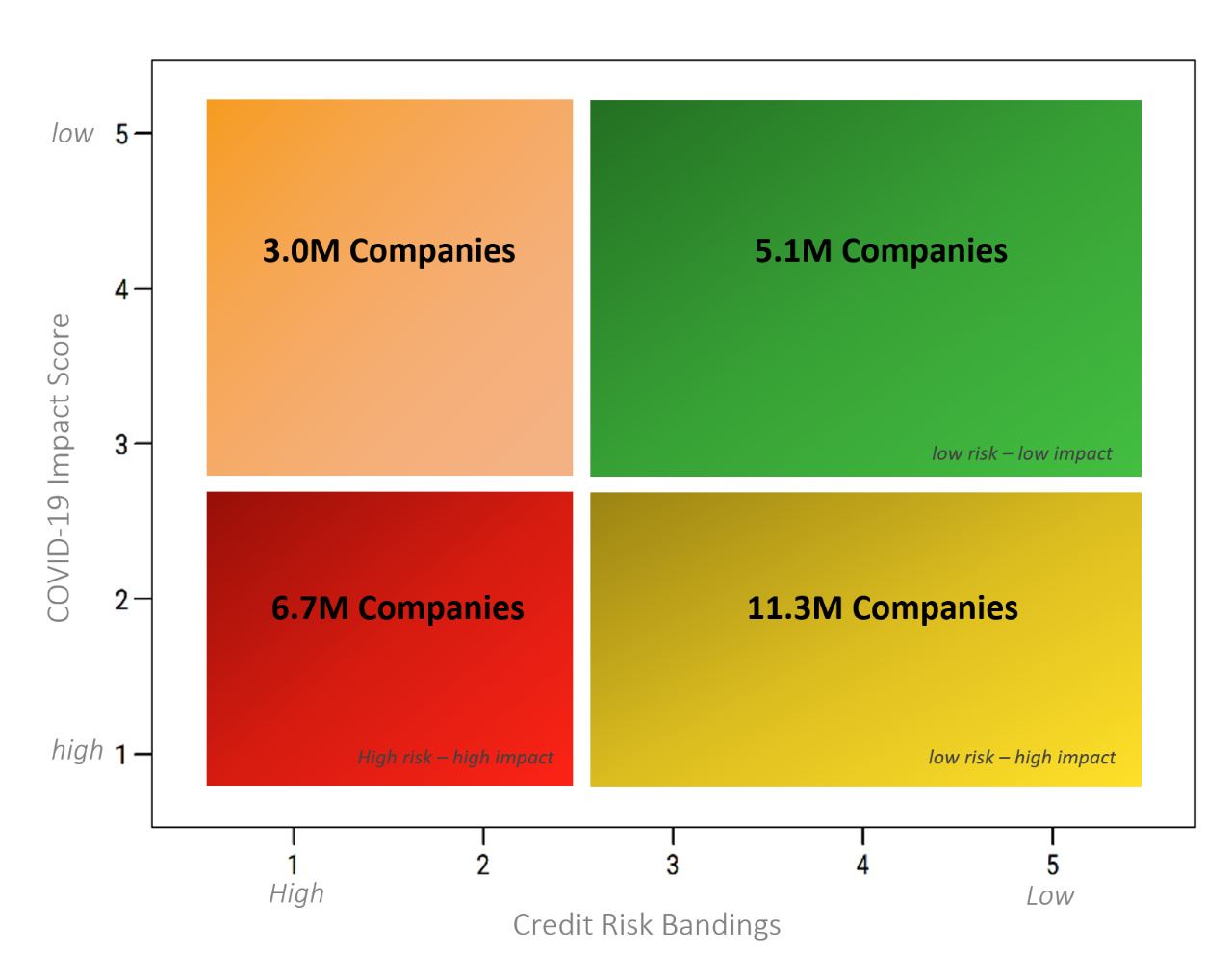

By blending an analysis of underlying credit risk with the impact of the coronavirus Creditsafe’s data science team identified 6.7 million US companies facing higher risk of bankruptcy.

We originally created our COVID-19 Impact Score to give businesses a chance to more clearly understand how the pandemic was likely to affect their business partners. However when you combine that impact with an understanding of the fundamental financial strength of a company as revealed by our standard credit score you can see that the risk is genuinely alarming with over 1 in 4 businesses at real risk.

Matthew Debbage

CEO of Creditsafe Asia and Americas

Creditsafe swiftly recognized that the current crisis has led to many businesses going into a self-imposed shutdown and potentially making knee-jerk credit policy reactions that only further impact the normal flow of trade as credit gets withdrawn or refused.

“We wanted to not just identify the issue, but also provide practical tools to help companies make better business decisions. To that end we have developed a Credit Management Decision Matrix that combines our COVID-19 Impact Score with our underlying credit risk score to highlight the best approach for businesses to take.”

Matthew Debbage

CEO of Creditsafe Asia and Americas

Chart A: Distribution of US companies based on COVID-19 Impact Score and Credit Risk Banding

The Credit Management Decision Matrix is an easy to use intuitive tool that allows companies to quickly segment their customers and business partners into four easy to manage groups and adjust their credit management policies accordingly. This will then give them the chance to maximize trading opportunities while sensibly mitigating risk.

“We are very keen to continue playing our part in protecting US businesses and the wider economy so that we can come out of this even stronger. Therefore we are making the Credit Management Decision Matrix available free of charge to all US companies.”

Matthew Debbage

CEO of Creditsafe Asia and Americas

For a complimentary protfolio review of your company that leverages this Credit Management Decision Matrix, please sign up at: Stay Safe Program