Knowing that business uncertainty is at unprecedented levels, Creditsafe USA challenged its expert team of data scientists to provide assistance to businesses understandably concerned and uneasy. By analyzing over 40 Million US companies, Creditsafe created the COVID-19 Impact Score which is designed to help businesses identify risk areas within their customer and supply chain portfolios. To maximize the benefit of the initiative, they have made this resource available for free to every U.S. business.

Knowing that business uncertainty is at unprecedented levels, Creditsafe USA challenged its expert team of data scientists to provide assistance to businesses understandably concerned and uneasy. By analyzing over 40 Million US companies, Creditsafe created the COVID-19 Impact Score which is designed to help businesses identify risk areas within their customer and supply chain portfolios. To maximize the benefit of the initiative, they have made this resource available for free to every U.S. business.

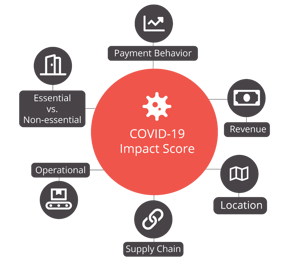

The Impact Score was developed using a combination of macro and micro economic indicators, federal, state, and local data, combined with real-time payment and other information. The Creditsafe Covid-19 Impact Score grades the likely disruption to any business on a simple scale ranging from A – very low risk of disruption through to E – very high risk of catastrophic disruption. Creditsafe’s analysis of the nation shows that almost 30% of U.S. companies are likely to face considerable disruption within the next 90 days.

The Impact Score differs from Creditsafe's core risk score, which predicts the likelihood of bankruptcy or severe delinquency in the next 12 months and should be used as an additional guidance indicator in these difficult times.

"Credit managers and other financial professionals can use this data to identify risk areas within their portfolios quickly. To give just one interesting example, it’s well known that

airlines are struggling right now however, our analysis is showing that charter flights are in high demand and are not likely to be nearly as impacted."

Matthew Debbage

CEO of Creditsafe Asia and Americas

.png?width=500&name=cq5dam.web.1280.1280%20(1).png)

"It's Imperative to recognize that this score should be used alongside our existing core risk score as a supplementary tool. Although we are in unique times, they do not overwrite the fundamentals of business and our experience through previous crises shows that our underlying prediction model remains a solid foundation for making business decisions. We have very deliberately not made any rash moves to rewrite our core score and are thereby continuing to support those strong companies that will be helping to rebuild our economy when this is all over, while also providing a valuable guide as to the virus's potential effect."

Matthew Debbage

CEO of Creditsafe Asia and Americas